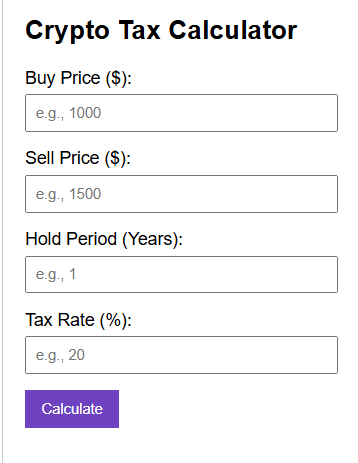

Crypto Tax Calculator

🧠 What Is a Crypto Tax Calculator?

The Crypto Tax Calculator helps digital asset investors estimate the taxes due on cryptocurrency transactions. Since crypto is classified as property in many countries (like the U.S.), every sale, trade, or use may trigger a taxable event, and this tool streamlines that process.

⚙️ How It Works

- Upload or enter your transactions – sells, trades, staking, mining.

- Choose your cost-basis method (FIFO, LIFO, Specific ID).

- Calculate short‑term vs long‑term capital gains.

- Estimate total taxable gains and tax owed based on your rates.

For U.S. users, the tool reflects IRS guidance: short-term gains taxed as ordinary income, long-term gains at reduced rates cryptotaxcalculator.iokoinly.ioinvestopedia.com+1koinly.io+1coinbase.com.

🧮 Example Calculation (Simplified)

- Held 0.5 BTC bought at $30,000, sold at $50,000 after 6 months.

- Gain: $10,000 → Taxed at ordinary income rate (~24%).

- Short-term Tax: $2,400

Another user sold 1 ETH purchased over a year ago at a $5,000 gain → taxed at long‑term rate (~15%).

📈 Visual Tax Report Flow

mermaidCopyEditflowchart LR

A[Import Transactions] --> B[Cost-Basis Method]

B --> C[Gain/Loss Calculation]

C --> D[Short/Long Term Split]

D --> E[Tax Estimate Report]

✅ Why Use EarnApki’s Crypto Tax Calculator?

- 🧾 Avoid IRS/Tax Authority Letters — Many are unaware that crypto is taxable investopedia.com+8news.com.au+8investopedia.com+8nerdwallet.com+2coinbase.com+2thetimes.co.uk+2investopedia.com.

- ⏱️ Save hours of manual work

- 📊 Clear breakdown of holdings and taxable events

- 🔀 Supports different cost-basis options

For more advanced reporting (wallet/exchange sync), expert tools like CoinLedger and Koinly offer automated imports and complete tax reports.wikipedia.org+1coinbase.com+1koinly.io+1coinledger.io+1.

📚 Related Internal Tools (EarnApki)

🌐 Trusted External References

- Koinly – Crypto Taxes USA Guide (Shows how to calculate taxable events and use tools) news.com.au+11koinly.io+11tokentax.co+11

- CoinLedger – Free Crypto Tax Calculator (Estimate tax liabilities and connect to exchanges) coinledger.io

- TurboTax – Cryptocurrency Tax Guide (Crucial tips for IRS compliance) turbotax.intuit.com

ℹ️ Tax-Saving Strategies

- 💡 Tax-Loss Harvesting – Realize losses to offset gains (up to $3,000/year) investopedia.com+1coinbase.com+1.

- 🧭 Choose optimal cost-basis – FIFO/LIFO/Specific ID can significantly impact taxes, investopedia.com.

- 📋 Maintain clean records – Required for IRS/CRA and audit defense.