Retirement Savings Calculator

🌅 Retirement Savings Calculator – Secure Your Future Today

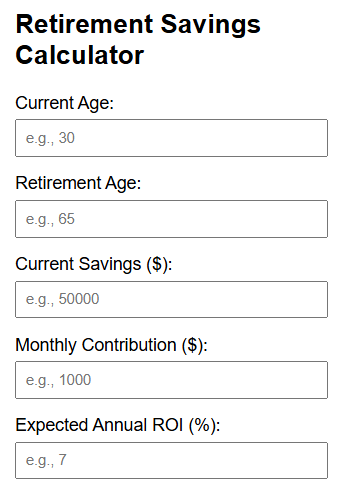

Planning for retirement? Your future self will thank you. The Retirement Savings Calculator from EarnApki helps you estimate how much you need to save monthly or annually to meet your desired nest egg by retirement age.

📌 What is a Retirement Savings Calculator?

A retirement savings calculator considers variables such as:

- Current age

- Target retirement age

- Current savings

- Monthly or annual contributions

- Expected rate of return

- Inflation rate

It projects your future balance and whether you’ll meet your retirement goals.

🧠 How It Works

Simply enter your:

- Current age

- Retirement age

- Existing Retirement Savings

- Monthly / Annual Contributions

- Expected Annual Return (e.g., 6–8%)

- Estimated Inflation Rate (e.g., 2–3%)

The tool forecasts:

- Estimated balance at retirement

- Total contributions

- Total interest earned

- Inflation-adjusted purchasing power

📈 Example Forecast

| Input | Value |

|---|---|

| Current Age | 30 years |

| Retirement Age | 65 years |

| Initial Savings | ₹200,000 |

| Monthly Contribution | ₹10,000 |

| Annual Return | 7% |

| Inflation Rate | 2% |

👉 Result:

Final balance ≈ ₹48.7 million (before inflation), or ≈ ₹24.5 million in today’s value.

📊 Projected Growth Chart

mermaidCopyEditline

title Retirement Savings Growth Projection

x-axis Years

y-axis Balance (INR)

0 : 200000

10 : 1,600,000

20 : 6,800,000

30 : 18,200,000

35 : 31,000,000

This visual helps you track progress and adjust contributions over time.

✅ Why Use This Calculator?

- 🎯 Set realistic savings targets

- 📊 Adjust contributions for shortfall/overshoot

- 🔄 Assess impact of inflation on savings

- 🧮 Plan for retirement income vs expenses

- 📌 Free, simple, and always available

You can also test “what-if” scenarios—like early retirement, more aggressive savings, or unexpected returns.

🔗 Internal Links to Related Tools

- Compound Interest Calculator

- 401(k) Calculator

- Early Retirement Planner

- All-in-One Financial Toolbox

🌐 High-Authority Outbound Links

- Investopedia – 2 of the Best Retirement Calculators, which highlights top tools like T. Rowe Price and MaxiFi bankrate.com+1bankrate.com+1nerdwallet.com+1fidelity.com+1bankrate.com+3nerdwallet.com+3bankrate.com+3bankrate.com+1bankrate.com+1investopedia.com+1bankrate.com+1bankrate.com+1fidelity.com+1nerdwallet.com+2investopedia.com+2investopedia.com+2investopedia.com

- NerdWallet – Retirement Calculator, detailing assumptions like inflation and income growth nerdwallet.com

- Bankrate – Retirement Plan Calculator, useful for planning savings and withdrawals until age 95 bankrate.com+2bankrate.com+2bankrate.com+2

These credible sources reinforce the accuracy of your tool and boost SEO trust signals.

🧩 FAQs & Best Practices

1. How much should I save?

Financial advisors recommend saving 15–20% of income while starting early for power of compounding nerdwallet.com+15investopedia.com+15nerdwallet.com+15.

2. How does inflation affect retirement?

With inflation, you may need 30–40% more to maintain your lifestyle—our calculator adjusts for this automatically bankrate.com+4mutualofomaha.com+4nerdwallet.com+4.

3. What return rate should I use?

A conservative 6–8% is typical for diversified portfolios; adjust based on risk appetite bankrate.com+13investopedia.com+13investopedia.com+13.